Hello, I'm

Abebaw Belay

Senior Systems Architect and Digital Financial Services (DFS) IT Manager specializing in Digital Public Infrastructure (DPI), FinTech, and instant payment systems. AAiT Alumnus dedicated to designing secure, scalable solutions that drive financial inclusion across East Africa.

Connect With Me

My Expertise

Digital Public Infrastructure (DPI)

Expert in designing and implementing DPI systems, digital financial services architecture, and instant payment solutions that drive financial inclusion

FinTech & Systems Architecture

Experienced in integrating complex financial systems, implementing payment gateways, and ensuring strict industry compliance and security standards

Risk Mitigation & AI Innovation

Applying machine learning and AI to optimize financial systems, enhance security protocols, and develop next-generation payment solutions

DFS Domain Expertise

Digital Financial Services (DFS) domain expertise represents specialized knowledge in delivering secure, scalable financial technology solutions—particularly to underserved populations. It goes beyond general IT skills to address the unique challenges of financial inclusion, compliance, and operational sustainability.

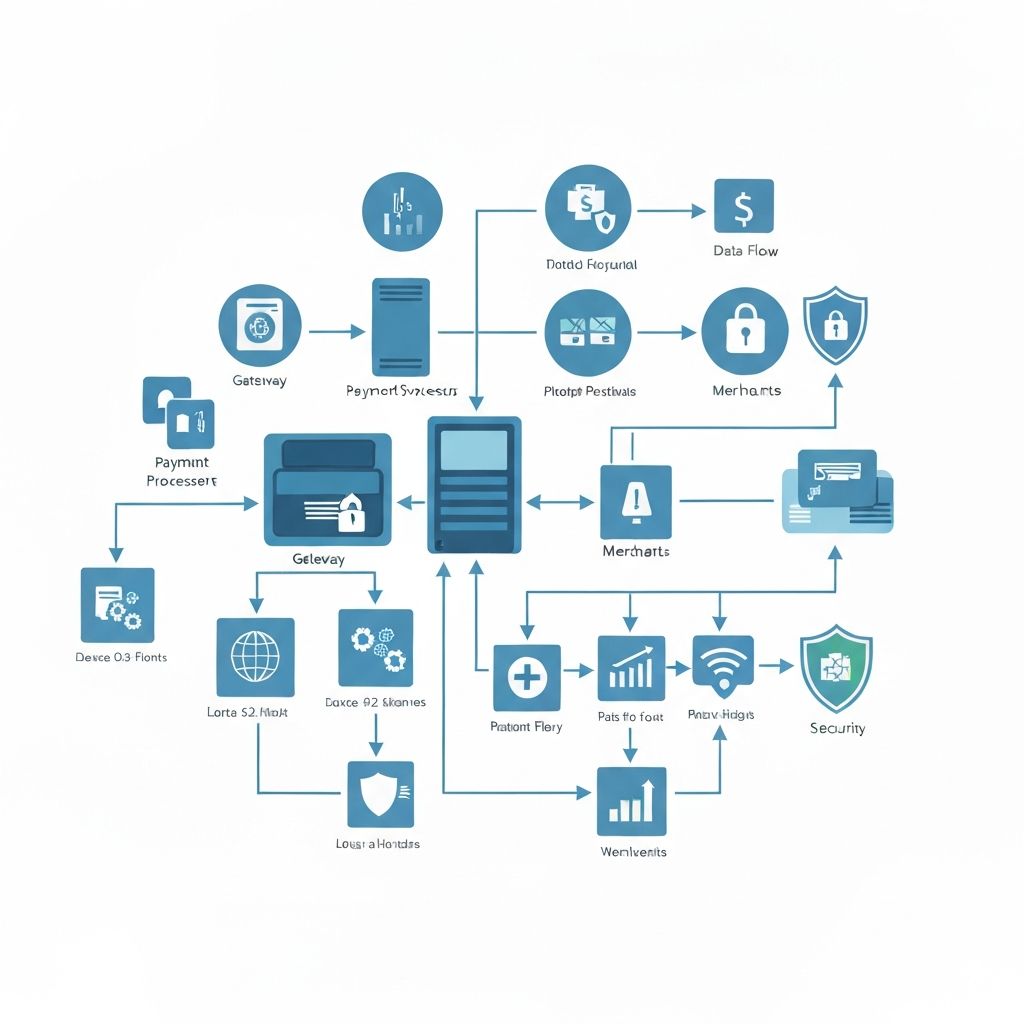

Technology and Architecture

Deep expertise in designing and implementing the technical systems that make digital payments possible and scalable. This includes payment infrastructure, real-time processing systems, API integration, data security architectures, and cloud-based solutions that support millions of transactions.

Operations and Business Models

Practical knowledge of running DFS networks efficiently. This encompasses vendor management, merchant acquisition, customer support systems, fraud detection, transaction settlement, business process optimization, and sustainable revenue models for digital financial services.

Regulatory and Market Landscape

Understanding of the legal, compliance, and market frameworks essential for DFS success. Includes navigating financial regulations, anti-money laundering compliance, data protection laws, market entry strategies, and ensuring systems remain trustworthy and strategically aligned with national development goals.

Key Projects & Initiatives

Building foundational payment infrastructure and advancing research at the intersection of digital public infrastructure, financial inclusion, and artificial intelligence.

Advanced Research Initiative

Digital public infrastructure represents the 21st-century equivalent of roads, railways, and power grids. Payment systems form the financial circulatory system, enabling value to flow securely, efficiently, and inclusively. Specializing in architecting the complex intersection of payment systems and DPI—the foundational systems that enable societal and economic functions at scale.

Academia Research

Working Title: "Deep Reinforcement Learning and Recurrent Architectures for Financial Time Series: A Systematic Review." Comprehensive literature review of DQN variants in financial applications, MDRNN architectures for multi-dimensional financial data, and hybrid approaches combining reinforcement learning with sequential modeling for payment fraud detection and system optimization.

Data Analysis Framework

A comprehensive data analysis structure for optimizing Ethiopia's agent network management. Integrates multi-dimensional data sources with advanced analytical techniques to transform raw data into actionable insights for network optimization, risk management, and financial inclusion enhancement across underserved populations.

Collaborative Research Project

"Optimizing Agent Network Management in Ethiopia: A Multi-Agent System Approach for Financial Inclusion." Applying agent-based modeling and multi-agent reinforcement learning to optimize network management, addressing urban-rural divides, infrastructure constraints, and regulatory frameworks for sustainable agent banking.

Shared Agent Network Platform

Leading the implementation of an interoperable 'Single sign-in' platform enabling agents to service customers across any connected financial institution. Designed to dramatically expand financial access at the last mile, directly advancing national financial inclusion goals.

National Payment Switch

Integral role in developing and launching Ethiopia's national payment switch. Led intensive cross-functional collaboration to achieve full payment interoperability between all participating financial institutions with advanced, national-scale payment infrastructure.

One-Stop Shop Utility Payment

Architected and implemented a centralized utility payment platform, establishing the foundational transaction layer for bill payments. Streamlined critical financial processes, enhancing accessibility and reliability for end-users across Ethiopia.

National ID Training Program

Led comprehensive training initiatives for Ethiopia's National ID system implementation, building local expertise in digital identity infrastructure. Focused on knowledge transfer and sustainable skill development for long-term system maintenance.